A brief summary of import charges since Brexit for our EU customers. The important thing to note is that you shouldn’t be paying a lot more for your goods.

The extra charge you will be paying since Brexit is approx. 4% duty on the value of the order and a customs fee of approx. EURO 10 or 15. That’s it.

VAT changes are really about timing of the payment – see below.

So for an order of EURO 1000, you would be charged EURO 40 for the 4% duty charge and EURO 10 ish for the custom fee. So an extra EURO 50 onto an order of EURO 1000, an extra 5% on your order.

Then there is the VAT.

EU wholesale customers with a VAT number:

Before Brexit we would send your order without charging VAT. But, you would then need to pay this VAT (along with any other VAT that is due) at the end of your next VAT period.

So, you previously paid VAT on the value of the order, at the end of your VAT quarter.

Now you pay VAT on the value of the order, before the package is released from customs.

The bottom line is that you pay the same VAT – you just pay the VAT sooner.

EU wholesale customers without a VAT number:

Before Brexit we would send your order and we would charge you VAT at the UK rate of 20%.

Now we do not charge VAT. But you need to pay VAT (at your country’s rate) on the value of the order, before the package is released from customs.

The bottom line is that you pay the VAT (at your country’s rate) – but you no longer pay VAT to TDi Body Jewellery. I hope this explains everything for you. If you have any questions do let me know. If you do find you are being charged more do send us a copy of the paperwork so we can see what they’re trying to charge and if it’s all in order.

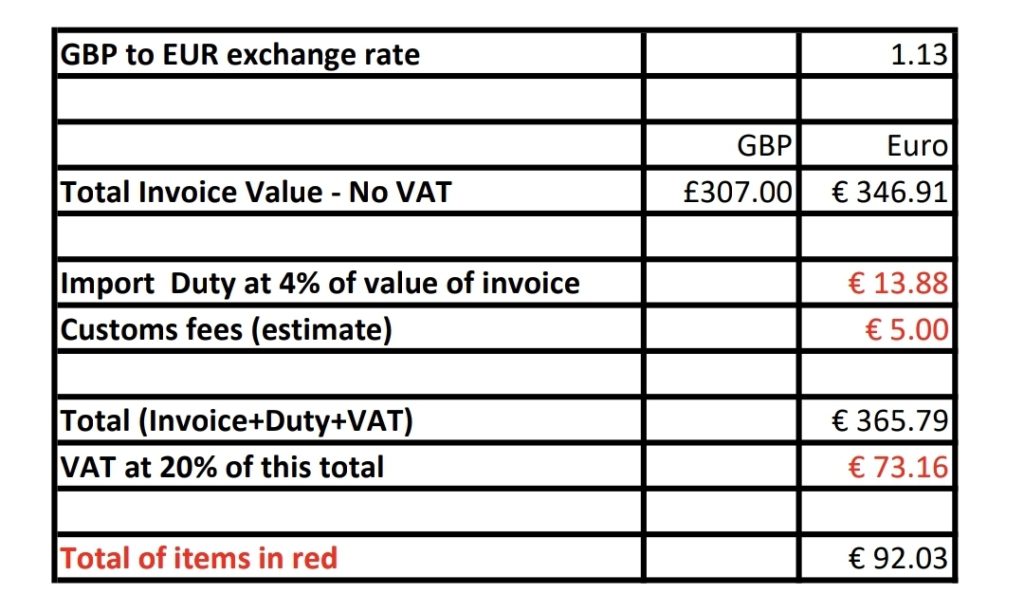

Here’s an example, hope this helps!

In this example the order of £307 was converted at an exchange rate of 1.13 to give €346.91. The receiving fee is €92 but this fee of €92 is a mixture of Duty, Customs fee and VAT (TVA).

Most of the €92 charge is VAT (TVA) (€73). This goes on your VAT return to claim back against your sales VAT.

Before Brexit, you would have had none of these fees in order to receive the package. But you would still have had to pay this VAT later – on your VAT return.

So, the extra charges because of Brexit is the duty and the customs fee – less than €20